CC Global Balanced Income Fund doubles net asset value, retains its Top Quartile Ranking

The CC Global Balanced Income Fund continues its positive trend in the second half of the year following a successful first half. Indeed, the fund retained its position in the top quartile over a five-year period* among global funds in its category, while its net asset value (Nav) has doubled over the past five years.

A strong year-to-date performance

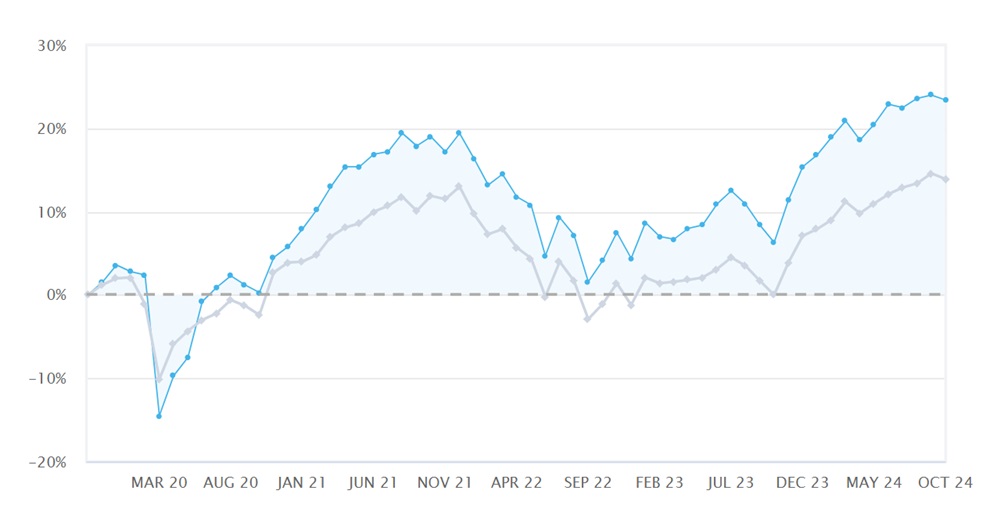

Following a period of market volatility in the first weeks of August, on the back of doubts namely about the U.S. economy and its sanity, the market rebounded strongly and the CC Global Balanced Income Fund bounced back with an impressive high single digit return of 9% since then, thus topping its year-to-date performance to 11.2% to date. From December 2019 to December 2024 the fund delivered a net performance of 27% thanks to its flexible asset allocation and active approach.

Light Blue CC Global Balanced Income Fund – Grey Sector Average

Since the Covid-19 period, market dynamics have changed notably, and the flexible mandate was and still is one of the variables for the CC Global Balances Income Fund success in terms of performance on a relative basis. As yields commence their ascending phase in 2021 following decades low, we have seen major asset classes experiencing heightened volatility over the past two-years, however volatility varied. Indeed, within the bond market, the theoretically considered low risk bonds, better known as high grade bonds, were pinched the most relative to bonds which are considered risky in nature, also known as high yield bonds. Given the flexibility of a multi-asset strategy, the Manager has the ability to add or reduce the fund’s asset allocation depending on market conditions in asset classes as opposed to restrictions in other strategies.

A strategic advantage with active management

As the change in market dynamics has brought about heightened volatility, active management remains vital in protecting downside risk, while taking opportunities of idiosyncratic risks.

The CC Global Balanced Income Fund’s active management style positions it to take opportunities in which the Manager believes there is underlying long-term value, and this is reflective in its performance which remained relatively strong over the past years.

Jordan Portelli, co-Portfolio Manager highlighted the fund’s success:

“The CC Global Balanced Income fund’s net asset value continued its growth over the past years as its active approach is reflective in its performance track record. Given the change in market dynamics the investment team had to adapt to this new norm. Despite that our core investment philosophy remains that of creating value through fundamental investing, we are now using other investment tools to achieve our objectives. Through our fine-tuned investment strategy, we have been pretty successful in capturing market opportunities which have aided in creating long-term value. This is reflective in the fund’s net asset value which in 2024 increased by 30%. As we head into 2025, despite we are very much aware of the challenges ahead, namely uncertainty surrounding geopolitics and the Trump administration, we think numerous investment opportunities will emerge. We remain confident that through our strategy we can lock-in long-term value creation for the fund.”

How to access the Funds

The funds are available through Calamatta Cuschieri Investment Services and on the Moneybase platform. Prospective Investors may book an appointment with an advisor at Calamatta Cuschieri by accessing here. Alternatively, you may call +356 25 688 688 or visit one of the Calamatta Cuschieri branches in Birkirkara, Mosta, Fgura and Sliema.

Calamatta Cuschieri Investment Services Ltd is a member of the Maltese Investor Compensation Scheme. Investments entrusted with us are covered under the Scheme in line with the Investor Compensation Scheme Regulations (S.L. 370.09).

Disclaimer

This is a marketing communication. This information does not represent and shall not be construed as investment advice, recommendation, or inducement to buy or sell financial instruments. Retail investors are urged to make their own research before making any investment decisions and should consider whether they fully understand the features of potential investments and the associated risks and should seek the assistance of a financial advisor if in doubt. Please refer to the prospectus of the UCITS and to the Key Information Document (KID), available on www.ccfunds.com.mt or at the address below, before making any final investment decision. The KID contains important information in relation to the security, including the associated risks.

The value of your investments may go down as well as up and may be affected by changes in currency. The performance figures quoted refer to the past and past performance is not a guarantee nor a reliable indicator of future performance.

CC Funds SICAV p.l.c. is licensed as a Collective Investment Scheme by the Malta Financial Services Authority under the Investment Services Act and qualifies as a ‘Maltese’ UCITS. Calamatta Cuschieri Investment Management Limited (“CCIM”) is licensed to conduct Investment Services in Malta by the MFSA under the Investment Services Act, approved for issue by CCIM, Ewropa Business Centre, Triq Dun Karm, Birkirkara BKR 9034.

*Source: https://citywire.com/selector/fund/calamatta-cuschieri-global-balanced-income-fund/c546446